Contact Us

Contact Us

To attract and keep global investments, Singapore has implemented a low corporate income tax rates and various tax incentives that subsequently contribute to the economic growth.

Singapore has adopted a single-tier corporate income tax system since year 2003. That means the tax paid by a company on its chargeable income is the final tax and dividends received by the shareholders from the company will not be subject to tax.

Year of Assessment (YA) refers to the year in which income tax is calculated and charged. In Singapore, corporate tax income is assessed in the preceding year basis. For example, if the income is earned in the financial year 2018, it will be taxed in year 2019.

The corporate income tax rate has been fixed at 17% since year 2010 for both Singapore tax resident and non-Singapore tax resident companies.

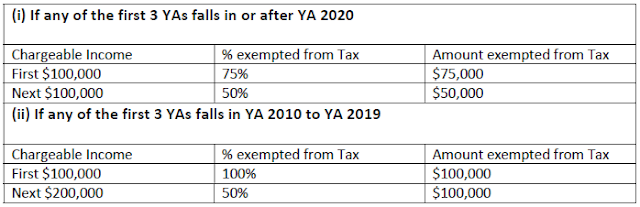

Tax Exemption for new start-up companies

Qualifying conditions for new start-up companies:

The above tax exemption is however, not available to investment holding companies and properly development companies.

Corporate income tax (CIT) rebate*

The companies in Singapore must file the income tax return by the statutory filing deadline which is 30 November every year.

Notwithstanding any objection or appeal against the Notice of Assessment raised, the tax liability has to be paid within 1 month after the service of that Notice.

If the company disputes the assessment, an objection has to be made within 60 days from the date of service of the Notice of Assessment stating precisely the grounds of the objection. Otherwise, the assessment may be treated by the Comptroller as final.

Certain payment made to non-residents like interest, royalty, technical assistance, rental, directors’ fee, etc are subject to withholding tax requirements unless exempt under the double taxation agreement arrangement with various countries.

Withholding tax is not applicable on dividend payment.